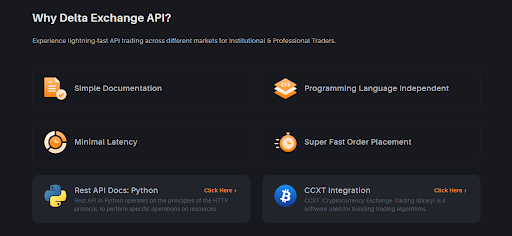

Trading today is fast-paced with speed, precision, and automation no longer considered luxuries – but necessities. This is exactly what API trading provides, enabling traders to automate strategies, execute trades in milliseconds, and access real-time data without manual effort. This article will allow you to grasp the fundamentals of API trading on Delta Exchange and help you take your first steps into algorithmic trading.

What is API Trading?

Source – AI-Generated | A young crypto enthusiast performing API trading.

API stands for Application Programming Interface. Think of it as a bridge that connects your trading account to custom software, such as a trading bot or script. Instead of manually clicking buttons on a trading platform, your program sends commands (like placing an order or fetching price data) directly to the exchange. This means your trading strategy can run 24/7, without human errors or delays.

Large institutions, hedge funds, and professional traders have long used APIs for high-frequency and algorithmic trading. But thanks to platforms like Delta Exchange, even retail traders with basic programming knowledge can leverage APIs.

Why Choose API Trading?

Here’s why API trading appeals to both beginners and pros:

- Speed – Execute orders instantly, without waiting for manual input.

- Efficiency – Let your computer handle repetitive tasks so you can focus on trading strategy and analysis.

- Customization – Design your own trading logic. From scalping trading bots to complex arbitrage systems, APIs let you build what you envision.

- Real-time data access – Fetch market data, price feeds, and order book info at lightning speed – crucial for time-sensitive strategies.

- Backtesting & Optimization – Run your trading strategy on historical data and fine-tune before deploying live.

Prerequisites for API Trading on Delta Exchange

To get started, you’ll need:

- A Delta Exchange account – Sign up and complete KYC to access API features.

- Basic programming knowledge – Python is recommended. If you understand variables, loops, conditions, and functions, you can create simple automation scripts.

- Familiarity with HTTP methods – REST APIs use GET, POST, PUT, and DELETE requests. You don’t need to master them, but a basic understanding helps.

- API key and secret – These credentials authenticate your trading bot with Delta Exchange.

Setting Up API Trading: Step-by-Step

Source | Delta Exchange API: The best of automated strategies and fast feeds.

- Log in or Sign Up

If you don’t have a Delta Exchange account, sign up, complete KYC using your email and mobile number, and you’re ready to go.

- Navigate to API Settings

Once logged in, click your profile icon → API Keys → Create API Key. You’ll be asked to:

- Name your API key (e.g., myBotKey)

- Select the IP to whitelist (choose My IP Address for direct connections)

- Set permissions (choose Read Data for testing or Trading for live execution)

- Generate API Key and Secret

Once you click Create, Delta Exchange will display your API key and secret.

Important: Save these securely – they won’t be shown again!

- Implement in Your Code

In your Python code (or other language of choice), use these credentials to authenticate requests. Delta Exchange provides sample code on their API docs page, making it easy to get started.

Key Security Tips

- Keep API keys confidential – Never hardcode them in public code repositories.

- Use IP whitelisting – Restrict access to trusted IPs.

- Limit permissions – Grant only the rights necessary for your trading bot (e.g., avoid trading permissions if you’re just fetching data).

- Enable two-factor authentication (2FA) – Adds a layer of protection when creating or managing API keys.

Debunking API Trading Myths

- Myth: API trading is only for advanced traders.

- Truth: If you understand basic programming and HTTP requests, you can start with simple automation.

- Myth: API trading eliminates all risk.

- Truth: While API trading improves execution speed, your trading strategy still determines your risk and profitability.

- Myth: API trading gives an automatic edge.

- Truth: API is a tool. Your trading logic defines success.

Additional Best Practices

- Test on demo or with read-only permissions first. This ensures your code behaves as expected without risking funds.

- Monitor your trading bot during live trading. Even automated systems can run into bugs or market anomalies.

- Keep your codebase updated. API endpoints or parameters can change – stay aligned with Delta Exchange documentation.

- Plan for failures. Include error handling in your code for network errors, API rate limits, or exchange downtime.

Final Thoughts

Delta Exchange provides the ideal platform for traders looking to leverage API trading – automated strategies, fast data feeds, etc, to gain a competitive advantage through technology. With only a basic understanding of programming languages combined with attention to security and trading strategy, you can build systems that allow for smarter and faster crypto trading.

Ready to take the plunge? Start experimenting with API keys, try out Delta Exchange’s demo mode, and begin designing your first trading bot today!

Want to see it in action?

Check out the YouTube video on API Trading for Beginners for a step-by-step walkthrough, complete with visuals and explanations. Perfect for first-time API users!

Prefer trading on the go? Download the Delta Exchange app on Android and iOS to stay connected anytime, anywhere.

For more information, visit the Delta Exchange website or join the community on X.

Disclaimer: Cryptocurrency trading involves a high degree of risk and may not be suitable for all investors. Prices are very volatile and subject to market risks. Readers are advised to carry out their own research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in compliance with applicable Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.