Crypto derivatives trading gives you more flexibility than spot markets. You can take long or short positions, plan trades around volatility, and manage exposure without owning the asset directly. That freedom comes with risk, and unmanaged risk can wipe out gains in a single session.

This is where Delta Exchange plays a practical role for traders who prefer structure over manual analysis.

Delta Exchange, among the best Indian crypto exchanges, focuses on tools that help you think in terms of outcomes, not just entry prices. From demo accounts to visual payoff tools, the platform supports decisions that feel planned rather than reactive.

Many would believe that Delta is one of the best apps for crypto trading – especially for derivatives – these features turn theory into daily habits.

Jump Ahead To:

Why Risk Management Matters in Crypto Derivatives Trading

Unlike spot markets, crypto derivatives trading moves much faster. Even a small change in the price of BTC or ETH can lead to much larger profits or losses when leverage is applied. That speed makes risk management a part of trading, not an add-on.

The focus shifts from trying to predict every market move to preparing for what could go wrong. If you set loss limits, manage capital exposure, and test strategies before committing real money, you tend to be more consistent over time. This reduces emotional decisions and keeps losses from spiraling out of control.

Delta Exchange supports this mindset by offering built-in risk management tools that encourage structured planning in crypto derivatives trading.

- Hedging

Hedging is one of the crucial risk control approaches in crypto derivatives. It allows you to protect one position using another.

For example, say you’re holding BTC and expect a short downtrend before a positive swing. A short futures or options position can balance that exposure, to focus on stability rather than extra profit.

This approach turns crypto derivatives into protective tools rather than pure speculation instruments.

- Portfolio diversification

Risk rarely comes from a single position. It builds up when all trades lean in the same direction, and portfolio diversification helps reduce that pressure.

Delta Exchange supports a range of crypto derivatives across multiple assets – BTC and over 100 altcoins. You can spread exposure between assets instead of stacking everything on a single idea.

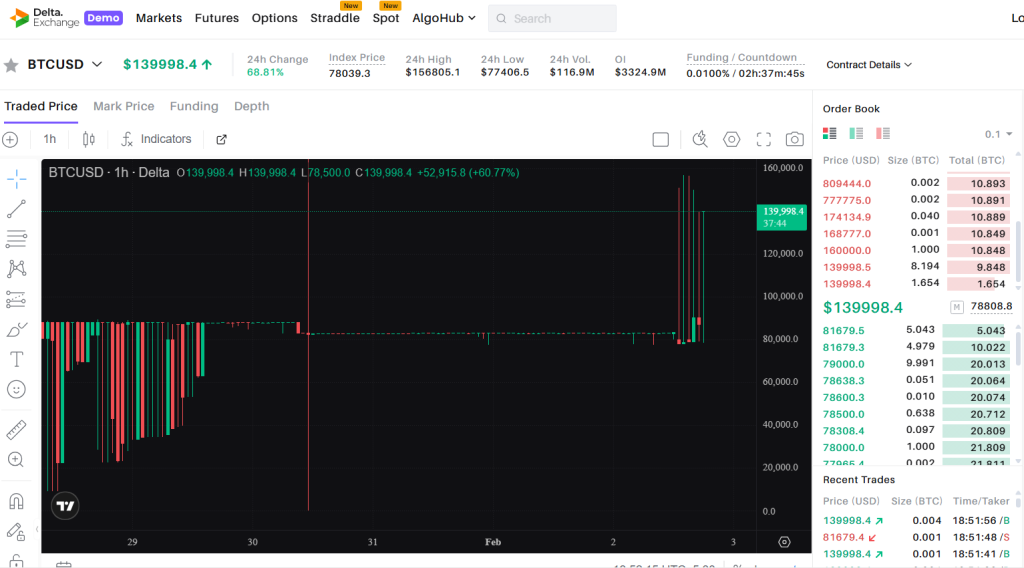

- Demo account

Many losses come from rushing into live trades without real practice. A demo account solves that by offering a realistic trading setup without real money at risk.

Delta Exchange provides a demo account where you can test strategies under real market conditions. Orders behave like live trades, charts move with the market, and results show how positions would perform.

This gives room to explore crypto derivatives without pressure.

The demo account turns risk management into a habit by building comfort with order types, margin behavior, and exit planning.

- Payoff charts

Numbers alone rarely show the full picture of a derivatives trade.

The payoff charts on Delta Exchange shows you how a position behaves when the price of BTC, ETH, or other assets moves up, down, or sideways. This tool highlights break-even points, maximum loss, and possible profit and loss zones.

Payoff charts bring clarity to trades that often look confusing on paper. They encourage thinking in terms of market scenarios rather than contemplating how orders would work out.

- Trading bots

Delta Exchange offers trading bots that bring automation into risk management. These bots follow pre-set rules so trades are driven by logic instead of emotion.

By automating strategies, you can control exposure even when markets move quickly or outside active screen time. Bots can be set to work within defined price ranges and risk limits, helping avoid overtrading and oversized positions.

This setup supports consistency, especially if you want discipline without monitoring charts all day. Automation here is less about speed and more about sticking to a plan, making it easier to manage risk across multiple trades.

Final Thoughts

Crypto derivatives bring opportunity along with pressure. The difference between long-term participation and quick exit often comes down to how risk is handled.

Delta Exchange supports risk management through hedging, portfolio diversification, demo accounts, and more.

If you’re exploring derivatives, Delta Exchange might be the best app for crypto trading.

To trade risk-free, visit www.delta.exchange and join the community on X for the latest updates.

Disclaimer: Cryptocurrency markets are subject to high risks and volatility. Kindly do your own research before investing.