In the past week, the crypto market has been mainly volatile, with a lack of significant factors affecting the overall market news. However, the inflow of mainstream currency funds has further increased, which is due to security concerns brought about by the previous week’s news factors. The overall market situation is still relatively optimistic. At present, the total amount of funds in the crypto market has increased compared to last week, rising from around $1.43 trillion to around $1.49 trillion. At present, the top five cryptocurrencies in the total market value of the crypto market are Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Ripple (XRP), and Solana (SOL).

Past Friday, major coins mainly fluctuated, with varying ranges of volatility. Several currencies have reached key price points and maintained small fluctuations. This article will study the performance of major assets, explore factors that affect their price trends, and conduct corresponding analysis to predict their future short-term price trends.

Bitcoin(BTC)

Bitcoin has risen by about 6.86% this week and is currently closing around $39,742, with a clear upward trend in the past week. At present, Bitcoin has reached its highest price point within a week and is expected to slightly decline after the closing. It is currently uncertain whether it can remain above the price of $39,500. Impacted by external news and market cycle fluctuations this week, the price of Bitcoin fell to a one week low of around $36,756 during the opening phase, but then began a stepwise upward trend, continuing into the closing phase of this week.

Analysis suggests that the price trend of Bitcoin began to further increase this week, influenced by the return of funds in the market. Currencies such as Bitcoin and Ethereum, which are clearly bullish in the medium to long term, have begun to show good upward trends. Although they still follow the overall tone of the market and the trend is mainly characterized by continuous fluctuations, the overall situation is better than the performance of the previous two weeks. At present, the price of Bitcoin has exceeded $39,000, and the bullish trend in the future has been strengthened. It is expected that the currency will return to the $40,000 price level in the last month of this year, which is a high probability event.

Bitcoin Price Data (Data Courtesy of CoinMarketCap)

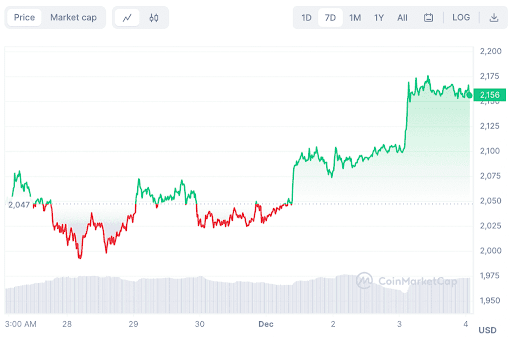

Ethereum(ETH)

Ethereum rose 5.16% this week and closed near $2,156. The price trend of Ethereum has maintained a strong correlation with that of Bitcoin this week, with a high point around $2,175, and a low point also affected by news factors and market cycles, falling to the $1,993 level. Compared to last week’s low point, there has been a certain overall increase.

Presently, there seems to be a certain breakthrough in the price increase space of Ethereum. Although the overall funding volume of the crypto market has not changed significantly, the direction of capital inflows has once again come to several mainstream currencies. Market users, due to regulatory and risk concerns, have once again increased the investment value of specific currencies such as Bitcoin and Ethereum. At present, the price of Ethereum is in the closing stage, and it is expected to experience a slight decline after the closing stage. However, the overall trend will remain higher than last week’s volatile trend. If there are no significant factors affecting the news, it is highly likely that the trend will remain stable in the next week.

Ethereum Price Data (Data Courtesy of CoinMarketCap)

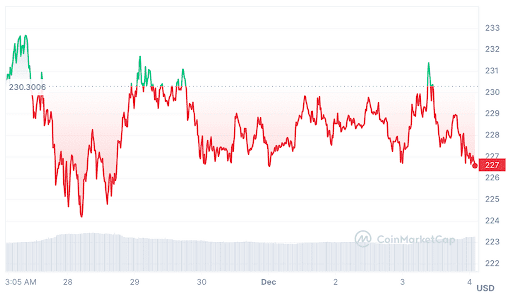

Binance(BNB)

BNB fell 1.47% this week and closed around $226, with little change compared to last week. This week, the overall price trend of BNB was mainly characterized by frequent fluctuations, but the price fluctuation remained within a relatively small range, without the same price drop as last week. The high point appeared around $232 in the opening stage, and the low point was $224.

Analysis suggests that due to the subsequent impact of the Binance case, the platform is currently in a stage of volatility and adjustment, with insufficient market confidence. Meanwhile, the outflow of funds has been ongoing, and the outside world’s view of Binance is conservative. This has led to a small range of sustained fluctuations in the BNB price trend this week, but overall it is relatively stable. The probability of continuing this trend in the next one or two weeks is relatively high.

BNB Price Data (Data Courtesy of CoinMarketCap)

Ripple(XRP)

XRP rose 0.56% this week and closed near $0.6188. The price of XRP continued its previous week’s trend this week, with relatively small fluctuations during the opening and closing periods. Within a week, the main trend was a fluctuating trend with a combination of downward and downward movements. The low point of the XRP price fell below $0.6 in the short term this week, but as it turned into an upward trend, the high point of the week appeared around $0.63 at the closing stage.

The analysis suggests that the overall trend of the current market cycle of XRP is mainly characterized by stable fluctuations. Although it is also affected by news factors and market sentiment, the price changes of the currency are generally concentrated in a small range. This is determined by the characteristics of the currency itself, and XRP will continue to maintain its current cycle state for a long time in the future, It is highly likely that it will change with the overall changes in the market, and the impact of news factors on the currency is generally limited.

XRP Price Data (Data Courtesy of CoinMarketCap)

XRP Price Data (Data Courtesy of CoinMarketCap)

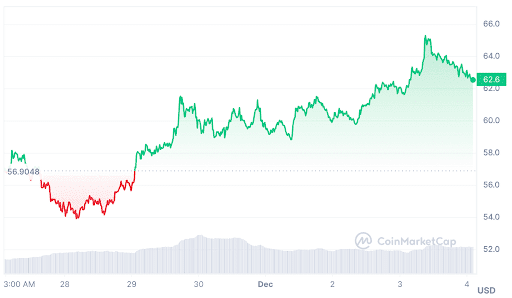

Solana(SOL)

Solana price fell 10.4% this week and closed near $62.57. The price of SOL has been in a volatile upward trend this week. Due to various news factors that occurred last week, the price of the currency has also shown a significant decline. This week, it has begun to show a new upward trend. Within a week, the price of SOL reached a high of $65.3 and a low of $53.94 at the opening stage.

Analysis suggests that the overall trend of SOL this week has shown a stable upward trend. Due to the increase in market liquidity, the medium and long-term bullish sentiment of the currency itself is quite common. Therefore, it is not surprising that the price increase of more than 10% in a week is not as high as the 30% increase in the previous week. However, for SOL, which has escaped the influence of unfavorable news factors this week, It can be considered as breaking through a key price point, and maintaining a sustained fluctuation above $60 has a significant positive impact on its subsequent price expectations.

SOL Price Data (Data Courtesy of CoinMarketCap)

What is to come?

The price performance of BTC, ETH, BNB, XRP, and SOL this week has been inconsistent compared to last week, with BNB continuing a slight decline, and most other mainstream currencies showing a clear upward trend. The price trends of several mainstream currencies in the short term have been explained separately, but the temporary impact of news factors cannot be ruled out. More accurate information needs to be obtained through daily market fluctuations.