Mt. Gox, the defunct crypto exchange, is set to begin the distribution of funds to its creditors on March 10. The deadline for repayments has been set for September 30 by the business’s Japanese bankruptcy trustee, Nobuaki Kobayashi. To receive their repayments, creditors must select a repayment method, register payee information online, and indicate how they want to receive their repayments. The original deadline for this selection and registration was scheduled for January 10, but was delayed by two months.

Jump Ahead To:

What is Mt. Gox?

Mt. Gox was once a very well-known and renowned Japanese crypto exchange. Headquartered in Shibuya, Tokyo; was at the time responsible for approximately 70 per cent of the global bitcoin trades. However, at the beginning of the year 2014, the firm suddenly stopped all functions and shuttered all operations. This happened during the wake of a ton of reports revolving around the fact that the company was involved in some way in the loss of a massive amount of BTC as well as capital valued at almost many hundred million dollars.

After Mt. Gox Filed for bankruptcy, users of the exchange faced massive setbacks and many also lost all their invested funds.

Last year, Mt. Gox announced that it will pay back its creditors who had a large capital locked in the company at the time of its collapse. Earlier the deadline for users to sign up for repayment was set for January 10, 2023, which was later pushed to March 10th, 2023.

Impact of the Rehabilitation plan: Is Bitcoin going to Crash?

According to this rehabilitation plan offered, creditors will be paid in either BTC or fiat. Users will also have the power to choose from various other options to customize how they receive these funds. However, there is one aspect that is becoming a huge concern in the industry. This plan could potentially cause a dump of 3 billion dollars worth of BTC. With the firm’s redemption in such a huge amount, the result could potentially hurt the price of bitcoin. There are speculations that as soon as these BTC funds will become available, users will dump them that will result in a negative outcome.

According to a report by CoinDesk, “While 850,000 bitcoins went missing from the exchange in 2014, it’s not that amount that’s potentially being disposed of, because the exchange has recovered 142,000 BTC along with 143,000 in bitcoin cash (BCH) and 69 billion Japanese yen ($510 million), representing about 20% of the hack.”

However, some experts like Ivan Kachkovski, a strategist at UBS, do still believe that the significance of this amount cannot be ignored. This figure of bitcoin comprises approximately a large 90 per cent of the aggregate of the supply that is active in the last one day. Similarly, it represents around 28 per cent of the average supple in the last week. Usually, when active supply increases by such a huge amount, it often weakens the value of BTC.

There is also a sentiment that this increase in supply when coupled with what is happening in the market currently could produce unfavourable results. In addition to the issues occurring at the Silvergate bank and the Ethereum network’s new and anticipated Shanghai update, the Bitcoin price could be driven to even lower levels.

Contrary Opinions

On the other hand, some experienced users and crypto influencers are also of the opinion that the actual amount that will come into the market will be a lot less. Additionally, not each one of the creditors will actually start selling their Bitcoin, and many will, in fact, persist to hold the asset. Users have witnessed a multitude of Bitcoin cycles and are aware of the fact that when there is a lower value for BTC in the market, the selling position is less attractive. Besides, those investors who are keen on selling, would have either already been bought out at the hands of larger funds or would have decided to modify their crypto vulnerability consequently.

According to Miles Deutscher, a very renowned crypto analyst “As per my prior reasoning, it is clear that not all creditors will sell. And even if they chose to, not all 137k $BTC would hit the market all at once. A pragmatic seller would be wise to DCA out of a position, just as you wouldn’t ape fully into a position. So, although there will be some impact from creditors selling, it is unlikely that it causes the doomsday-esque crash many people are calling for.”

137k (~$3b) worth of #Bitcoin could be dumped onto the market, 8 years after the Mt. Gox hack.

Some are labelling this as the biggest “black swan” in $BTC history.

: What you need to know about Mt. Gox: A fascinating story of hacks, lies and deceit.

— Miles Deutscher (@milesdeutscher) July 9, 2022

The Shanghai Update

With the Shanghai update, validators on the Ethereum network will be able to retrieve their ETH from the Beacon chain. It will allow users with staked ETH to withdraw their funds and go on to sell it in the market once again. This development will most likely materialise in April and is expected to create a bullish sentiment for Ethereum staking.

Despite this, another opinion is prevalent that believes it could potentially multiply selling pressure. There are a lot of mixed ideas surrounding what this could do for the price of Ethereum. In all likelihood, while an impact will be created, it might not be as catastrophic and the selling pressure won’t overwhelm the demand massively.

Also Read: Ethereum Shanghai Upgrade Delayed by Two Weeks, Capella Upgrade to Enable ETH Withdrawals

40k $BTC Move

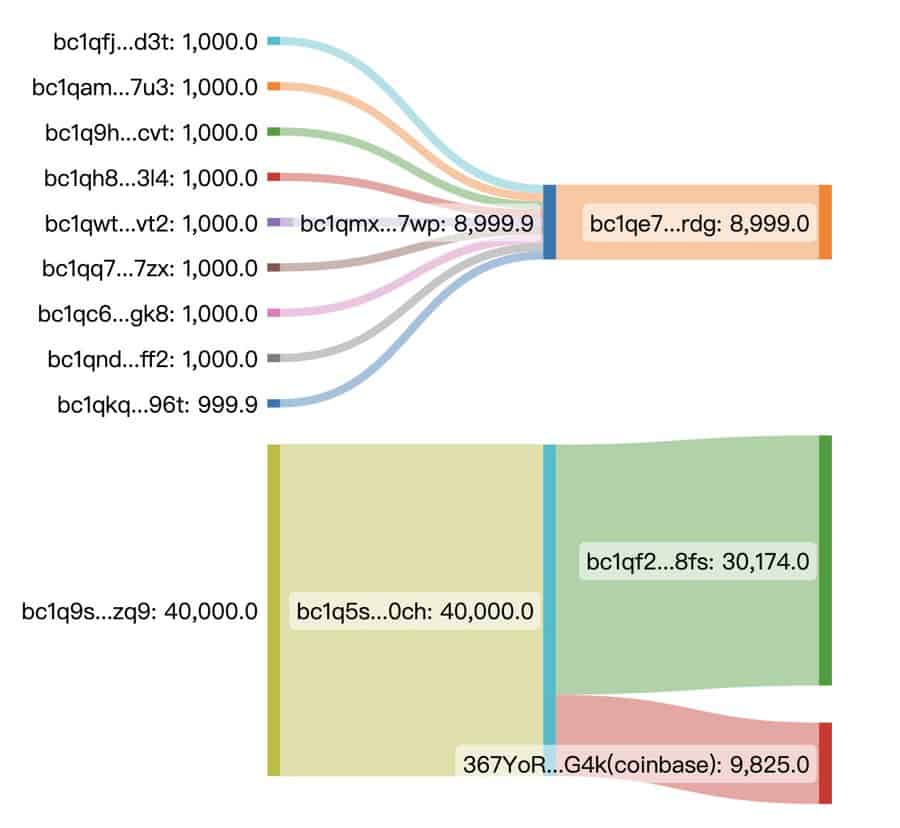

In another recent update, around 40 thousand BTC was found transferred from crypto wallets that were linked with US Government law enforcement seizures to Coinbase. These moves include those to Coinbase, wallet address bc1qf2…fsv ( around 30 thousand $BTC) and approximately 9 thousand BTC to the address bc1qe7…rdg.

Around 51,351.9 had been captured from the SilkRoad hackers in 2021 November and 2022 March. These funds were capsulized in two different addresses: bc1q5s…0ch and bc1q2ra…cx7. In this recent move, we saw approximately 9,861 $BTC that work taken from this Silk Road hacker transferred to the Coinbase cluster.

It will be interesting to see if these Bitcoins were moved with the motive to sell for FIAT. In my opinion, March could end up in RED for Bitcoin holder. In my opinion, BTC could be trading well below 20,000USD in coming months.