Ripple Labs emerged victorious in its legal battle against the Securities and Exchange Commission (SEC) as Judge Analisa Torres of the United States District Court in the Southern District of New York ruled in favor of the company. The case, which has been ongoing since December 2020, centered around allegations that Ripple was offering an unregistered security through its XRP token.

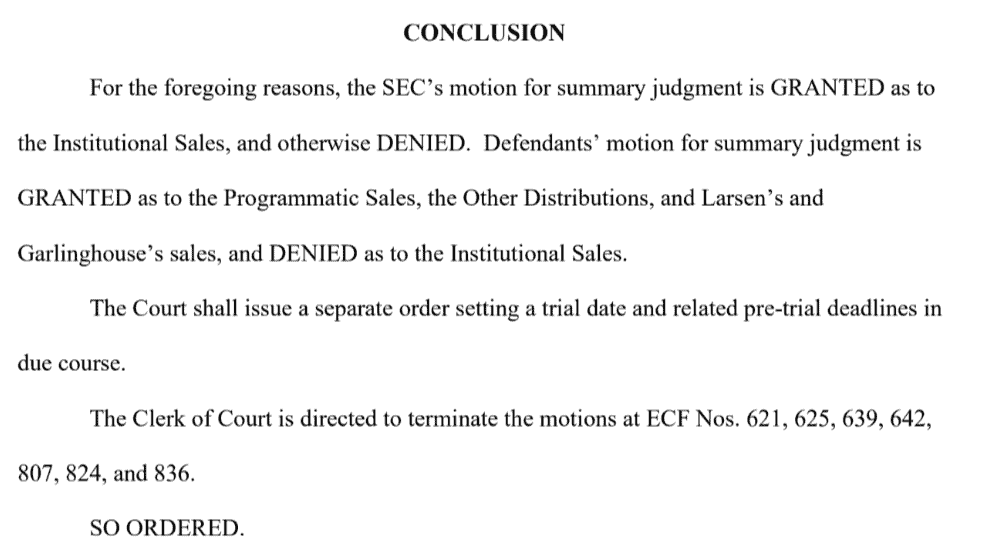

The ruling, announced on July 13, granted summary judgment in favor of Ripple Labs on several key aspects. The court documents revealed that the motion for summary judgment was granted for the Programmatic Sales, the Other Distributions, and the sales made by Ripple executives Brad Garlinghouse and Chris Larsen. However, the motion was denied concerning Institutional Sales.

XRP vs SEC Legal Case: Key Notes

- Ripple Labs secures a significant legal victory as the court rules in its favor in the SEC vs Ripple case.

- Judge Analisa Torres grants summary judgment for programmatic sales, other distributions, and sales by Ripple executives, while denying it for institutional sales.

- XRP experiences a price surge of over 25% immediately following the court’s decision.

- The ruling establishes that XRP sales on exchanges are not considered securities, providing clarity for Ripple and the broader cryptocurrency industry.

- The outcome emphasizes the importance of selling through exchanges and native protocol distribution, setting a precedent for future token sales.

The impact of the ruling was immediately felt in the cryptocurrency market, as the price of XRP surged from $0.45 to $0.61 within minutes after the news broke. This represents a remarkable increase of over 25% at the time of reporting, demonstrating the positive response from investors and the broader crypto community.

The SEC’s lawsuit against Ripple accused the company of conducting sales of XRP as an unregistered security, seeking to impose additional regulatory measures on the cryptocurrency. However, the court’s ruling rejected the notion that XRP sales on exchanges should be classified as securities, providing a significant legal win for Ripple.

The decision highlighted the distinction between sales made through exchanges and those conducted via institutional channels or private rounds. The ruling clarified that sales to users through exchanges, as long as they were executed through order books rather than ICOs, IEOs, or launchpad platforms, are deemed permissible. Additionally, bounties, investments in other projects using XRP, grants using XRP, and transfers of XRP to executives were excluded from being considered securities.

This favorable outcome not only bolsters Ripple’s position but also carries broader implications for the entire cryptocurrency industry. It provides clarity on the regulatory landscape, promoting the legitimacy of selling tokens through exchanges and advocating for native distribution via protocols.

While the complete ruling is yet to be released, the initial verdict has already sparked jubilation within the crypto community. Market participants and enthusiasts are optimistic about the potential impact on altcoins and the future of token sales, as the ruling sets a precedent that may influence how similar cases are approached.

The SEC vs Ripple case serves as a reminder of the evolving regulatory environment and the need for clear guidelines surrounding digital assets. The ruling underscores the importance of adhering to specific selling and distribution methods to avoid securities classification, encouraging token issuers to pursue public order books and native protocol-based distribution as viable alternatives.

On this news, XRP price shot up to 0.6USD, trading 30% above yesterday’s price.

What’s next in SEC vs Ripple case? The next step in the case between Ripple and the SEC is a trial. Since summary judgment was denied for certain issues, those matters will be addressed and examined further during the trial proceedings.