Cryptocurrencies can mean different things to different people. To the skeptic, it is the new age Tulip Mania while to the hopeful it is the tool to achieve a financial utopia. However, most opinions lie somewhere in between these polar opposite views.

This broad range of opinions is a function of a few developing factors in the current financial and geopolitical ecosystem. There is an increasing lack of trust in centralized institutions; be it big banks, investment firms, rating agencies, or a particular country’s central bank. People are beginning to recognize the failure of centralization in general and in many ways cryptocurrencies offer an alternative.

This sentiment of distrust in traditional institutions and the advent of new technology in cryptocurrencies has given rise to a viewpoint that the current financial infrastructure is in the midst of “A Great Reset”. The change might be incremental, spanning over decades, or it might be sudden, but the wind of change is blowing. This brings in some opportunities.

A brand new asset

Historically, any new asset in the market comes with two characteristics: High risks and high rewards. Talking about the risks involved, it is certainly decreasing as the crypto market matures and finds its stride. The mere fact that a critical mass of credible entities and institutions is now engaging with crypto assets has cemented their position as an official asset class. The rewards on the other hand are much higher. Cryptocurrencies can be in the portfolios of less than 5% of the global population. The growth potential is huge, just based on the factor of adoption.

The availability of historical numbers to match that of cryptocurrencies is low. However, we can draw some parables. Tech stocks, a subset of the stock universe, are mostly correlated to other equities. Amid the current pandemic, the Technology sector’s weighting jumped by 5 percentage points, from 23% at the close of 2019 to 28% at year-end 2020 (tech sector weighting of S&P 500). This increase is in just the last couple of years. If we go back a couple of decades, the weighting was just in single digits.

The popularity of tech stocks was possible because of a couple of factors. The advent of the internet, personal computers, and smartphones provided the necessary infrastructure while the inefficiencies of traditional businesses provided the motivation for adoption. The time for cryptocurrencies to be popular is right now, with global retail investor’s eyes on the inflation and distrust in the current monetary system at its peak.

Best performing asset for over a decade

Investors can reduce risk and enhance returns by investing in various asset classes — stocks, bonds, real estate, commodities, venture capital, etc. — especially if they are non-correlated, or don’t all go up and down in value together. The crypto market, in many ways, is in a sweet spot currently. The market cap currently is at about 1.5 trillion dollars, which is not too big to peg itself to other established asset classes whereas big enough to be taken seriously by retail and institutional investors alike.

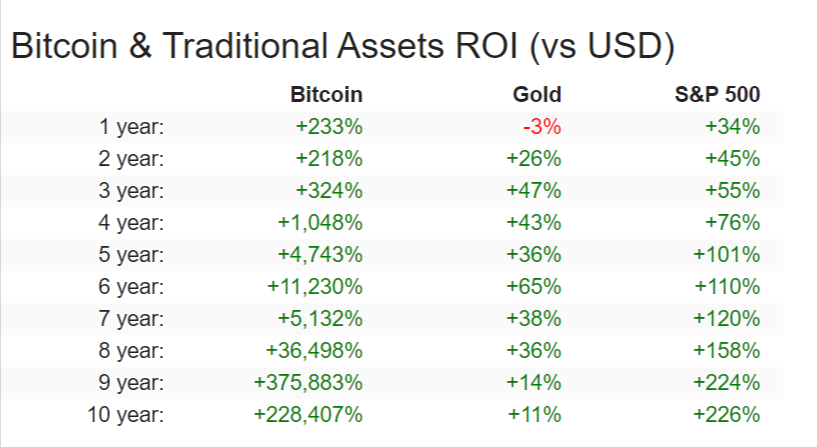

As such, price movements for cryptocurrencies have not always followed a predictable pattern and can swing with investor whims. But because cryptocurrencies are such a new asset class, it’s difficult to establish the correlation of cryptocurrencies to other assets within the broader economy. However, one thing is for certain. The return of investment on cryptocurrencies, especially Bitcoin has been massive.

Since 2011, Bitcoin’s cumulative gains have exceeded 20,000,000%, far outpacing the cumulative gains of the Nasdaq 100 and US Large Caps, which recorded returns of 541% and 282%, respectively. These returns coupled with its somewhat asymmetrical traits is the primary reason Bitcoin and other cryptocurrencies are finding its way to investor’s portfolios.

Ushering a new era of FinTech

Although the current FinTech revolution has helped people while shooting the valuation of these companies to great heights, there is a problem. They rely on the centralized infrastructure of traditional financial institutes. They are centralized too. What cryptocurrencies offer is a new world, a decentralized world. There is no need to depend on custodians and middlemen like the banks to store money or validate transactions.

In Proof of Work blockchains like Bitcoin validate transactions by a process called mining. It requires the people who own the computers in the network to solve a complex mathematical problem to be able to add a block to the chain. Solving the problem is known as mining, and ‘miners’ are usually rewarded for their work in cryptocurrency.

But mining isn’t easy. The mathematical problem can only be solved by trial and error and the odds of solving the problem are about 1 in 5.9 trillion. It requires substantial computing power which uses considerable amounts of energy. This means the rewards for undertaking the mining must outweigh the cost of the computers and the electricity cost of running them.

If you want to participate in the new financial revolution, be on the right side of the turning tides, you can start to invest in cryptocurrencies. However, if you want to earn cryptos, you can start mining. If you don’t want to go through the hassle of mining yourself, there are brands like Mining City to help. Mining City is a global platform offering this computing power called Hash Power to its users. There are a variety of mining plans to choose from that caters to a variety of users and their requirements.